An auditor’s permanent file audit documentation most likely will contain – An auditor’s permanent file audit documentation serves as a critical repository of information that supports the audit process. This documentation provides a comprehensive record of the auditor’s understanding of the client’s business, the audit procedures performed, and the findings obtained during the audit engagement.

The content of an auditor’s permanent file audit documentation varies depending on the size and complexity of the client’s business, as well as the specific industry in which the client operates. However, certain key components are typically included in most permanent file audit documentations.

1. Overview of an Auditor’s Permanent File Audit Documentation

An auditor’s permanent file audit documentation serves as a comprehensive repository of information that is relevant to the audit process. Its purpose is to provide a foundation for the audit engagement, ensuring that the auditor has a thorough understanding of the client’s business and the relevant regulatory environment.

The documentation typically includes information such as the client’s organizational structure, industry background, financial statements, and relevant contracts. It also contains details of the auditor’s planning and risk assessment procedures, as well as any significant findings or recommendations from previous audits.

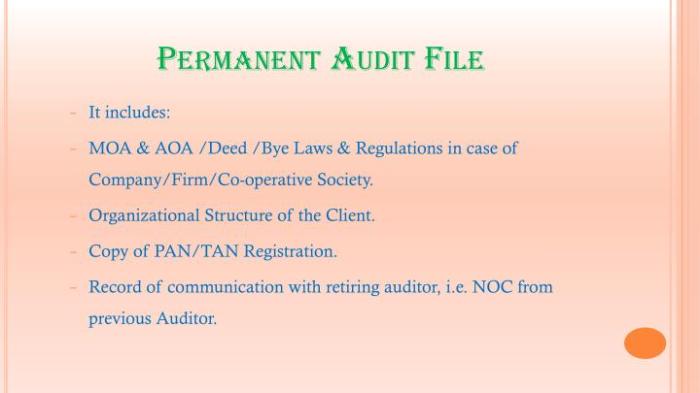

2. Key Components of an Auditor’s Permanent File Audit Documentation

Client Profile

- Legal structure and ownership

- Business activities and industry

- Key management and governance

- Financial performance and condition

Industry-Specific Information, An auditor’s permanent file audit documentation most likely will contain

- Regulatory framework

- Industry best practices

- Common risks and fraud schemes

Audit Planning and Risk Assessment

- Audit strategy and objectives

- Risk assessment procedures

- Materiality levels

- Audit team composition and responsibilities

Audit Findings and Recommendations

- Summary of significant findings

- Management’s response to findings

- Recommendations for improvement

3. Industry-Specific Considerations

The content of an auditor’s permanent file audit documentation may vary depending on the industry in which the client operates. For example, an audit of a financial institution will likely include information on regulatory compliance and risk management, while an audit of a manufacturing company may focus on production processes and inventory management.

Industry-specific considerations may also include:

- Unique accounting principles

- Specialized terminology

- Relevant laws and regulations

4. Best Practices for Maintaining an Auditor’s Permanent File Audit Documentation: An Auditor’s Permanent File Audit Documentation Most Likely Will Contain

To ensure the effectiveness and reliability of an auditor’s permanent file audit documentation, it is crucial to adhere to best practices for its maintenance.

Organization and Accessibility

- Maintain a logical and consistent filing system

- Use descriptive file names and indexing

- Ensure easy access for authorized personnel

Security

- Implement physical and electronic security measures

- Restrict access to sensitive information

- Back up documentation regularly

Regular Reviews and Updates

- Review documentation periodically to ensure its accuracy and relevance

- Update documentation as new information becomes available

- Consider the impact of changes in the client’s business or regulatory environment

5. Legal and Regulatory Requirements

Auditors are required by law and professional standards to maintain adequate audit documentation. Failure to do so can result in legal consequences, including:

- Loss of professional license

- Civil liability

- Criminal charges

FAQ Overview

What is the purpose of an auditor’s permanent file audit documentation?

An auditor’s permanent file audit documentation provides a comprehensive record of the auditor’s understanding of the client’s business, the audit procedures performed, and the findings obtained during the audit engagement.

What are the key components of an auditor’s permanent file audit documentation?

Key components of an auditor’s permanent file audit documentation typically include the audit plan, risk assessment, internal control evaluation, analytical procedures, audit procedures performed, and audit findings.

How does the content of an auditor’s permanent file audit documentation vary across different industries?

The content of an auditor’s permanent file audit documentation may vary across different industries depending on the specific risks and regulations applicable to the industry.