The everfi introductory financial concepts answers provide a comprehensive and engaging overview of essential financial principles, empowering students with the knowledge and skills to make informed financial decisions.

This innovative program covers a wide range of topics, including budgeting, saving, investing, and credit management, fostering financial literacy and responsible financial behavior among students.

1. EverFi Introductory Financial Concepts

Overview

EverFi’s Introductory Financial Concepts program empowers students with essential financial knowledge and decision-making skills. Designed for high school and college students, it aims to enhance financial literacy and promote responsible financial behavior.

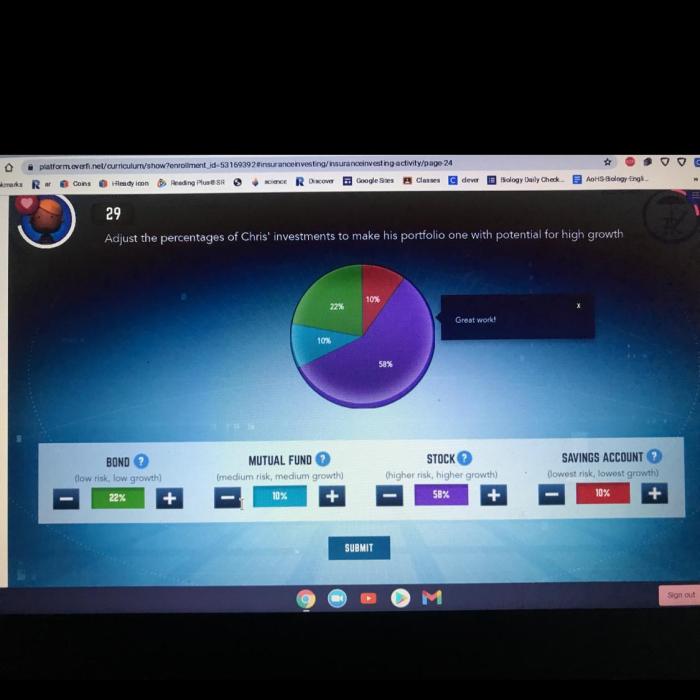

The program covers key financial concepts, including budgeting, saving, investing, credit, and debt management. By providing interactive content, real-world simulations, and engaging activities, EverFi makes learning about personal finance accessible and engaging.

Financial Literacy and Decision-Making, Everfi introductory financial concepts answers

EverFi’s program fosters financial literacy by equipping students with the knowledge and skills necessary to manage their finances effectively. It teaches them how to:

- Create and maintain a budget

- Save and invest for the future

- Understand and use credit responsibly

li>Manage debt effectively

Through interactive simulations and real-world scenarios, students learn to make informed financial decisions, weigh the consequences of their choices, and develop a sound financial plan.

Interactive Content and Engagement

EverFi’s program utilizes a variety of interactive elements to keep students engaged and motivated. These include:

- Interactive simulations and games

- Real-world case studies

- Interactive videos and animations

- Gamification and rewards

These elements make learning about personal finance enjoyable and help students retain information more effectively.

Assessment and Evaluation

EverFi’s program provides robust assessment and evaluation tools to track student progress and measure program effectiveness. These include:

- Pre- and post-program assessments

- Interactive quizzes and exercises

- Detailed reporting tools for educators

The program aligns with national financial literacy standards, ensuring that students are meeting the necessary requirements for financial competence.

Implementation and Impact

EverFi’s Introductory Financial Concepts program is easy to implement and integrate into existing curricula. It is available online and can be accessed by students anytime, anywhere.

Research has shown that the program has a positive impact on student outcomes, including:

- Increased financial knowledge and literacy

- Improved financial decision-making skills

- Increased confidence in managing personal finances

By providing students with the tools and knowledge they need to succeed financially, EverFi’s Introductory Financial Concepts program empowers them to make informed choices and achieve their financial goals.

Q&A: Everfi Introductory Financial Concepts Answers

What are the key financial concepts covered in the EverFi Introductory Financial Concepts program?

The program covers a wide range of financial concepts, including budgeting, saving, investing, credit management, and responsible financial behavior.

How does the program help students develop financial literacy skills?

The program provides interactive simulations, real-world scenarios, and gamification elements to engage students and reinforce financial literacy concepts.

How is the program assessed and evaluated?

Student progress is assessed through quizzes, assignments, and interactive simulations. Educators have access to reporting tools to track student performance and identify areas for improvement.